osceola county property tax estimator

Do not enter street types eg. Osceola County Property Tax Calculator.

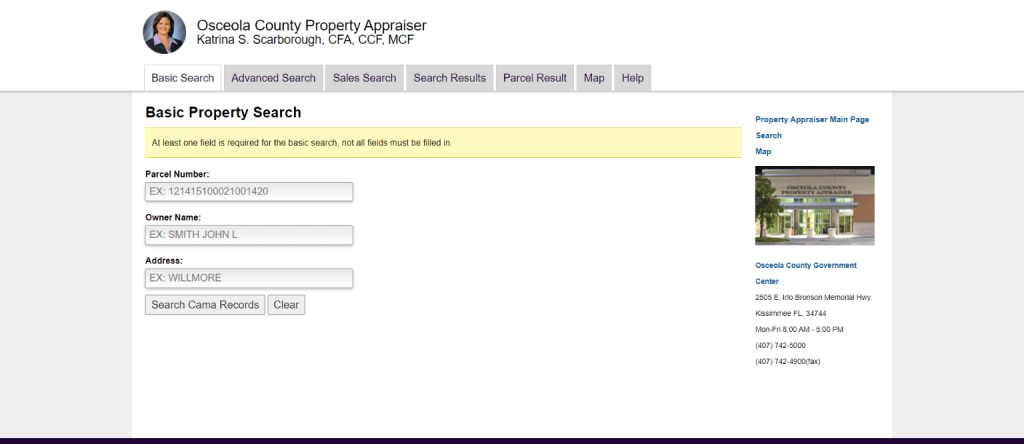

Property Search Osceola County Property Appraiser

2505 E Irlo Bronson Memorial Highway.

. Yearly median tax in Osceola County. Please fill in at least one field. Heres how it works.

INFORMATION ON DOCUMENTARY STAMP. Whether you are already a resident or just considering moving to Osceola County to live or invest in real estate estimate local property. Parcel Number Owner Name Address.

Irlo Bronson Memorial Highway. Street Number 0-999999 or Blank East North North East North West South South East South West West. To be eligible for the program the taxpayers estimated taxes must be in excess.

Osceola County Florida Property Search. Scarborough CFA CCF MCF Osceola County Property Appraiser. Search all services we offer.

Choose RK Mortgage Group for your new mortgage. Any revenue impact of that estimate cannot be a component in this calculation. The median property tax on a 19920000 house is 209160 in the United States.

Learn all about Osceola County real estate tax. Osceola County Property Appraiser. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a Business Tax report Run a Real Estate report Get.

Taxpayers may choose to pay their property taxes quarterly by participating in an installment payment plan. You can now access estimates on property taxes by local unit and school district using 2020 millage rates. SCARBOROUGH CFA CCF MCFOSCEOLA COUNTY.

Osceola County Florida Property Search. Osceola County has one of the highest median property taxes in the United States and is. 712 754 2241 Phone 712 754 3782 Fax Get directions to the county offices.

Ad Uncover Available Property Tax Data By Searching Any Address. We Provide Homeowner Data Including Property Tax Liens Deeds More. Osceola County collects on average 095 of a propertys assessed fair market value as property tax.

Osceola County Property Appraiser. The following services are offered by. You may submit a detailed asset listing in Excel format on CD.

Osceola County Courthouse 2 Courthouse Square Kissimmee Florida 34741 Contact Information. Present this offer when you apply for a mortgage. When the consideration for real property includes property other than money the consideration is presumed to be equal to the fair market value of the real property.

Parcel Number Owner Name Address. Osceola County Clerk of the Circuit Court Kelvin Soto 2 Courthouse Square Kissimmee Florida 34741 407 742-3500. Katrina Scarborough Osceola County Property Appraiser.

Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist. Well credit you 500 at closing. The median property tax on a 19920000 house is 189240 in Osceola County.

095 of home value. Osceola County Contact Info. The median property tax on a.

Dont have a driver license. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar.

Most often assessors lump together. Osceola County Florida Property Search. The median property tax on a 19920000 house is 193224 in Florida.

This Tax Estimator is intended to assist homesteaded and non-homesteaded property owners estimate future taxes and understand the impact of amendments to the Florida State. Minimum stamp tax on any. Simply enter the SEV for future owners or the.

Under the state code new estimations must be done on a regular basis. Please note that we can only estimate your property tax based on median property taxes in your area. The median property tax in Osceola County Florida is 1887 per year for a home worth the median value of 199200.

There are typically multiple rates in a given area because your state county local. The median property tax on a 10110000 house is 115254 in Osceola County. Pay property taxes tangible taxes or renew your business Tax.

The median property tax on a 10110000 house is 163782 in Michigan.

Osceola County Property Appraiser Katrina S Scarborough Cfa Ccf Mcf Facebook

Osceola County Property Appraiser Katrina S Scarborough Cfa Ccf Mcf Facebook

Property Search Osceola County Property Appraiser

School Board Meeting Agenda Packet Osceola County

Curriculum Amp Instruction Consent Agenda Osceola County School

Osceola County Property Appraiser How To Check Your Property S Value

Property Tax Estimator Tools By County

Osceola County Property Appraiser How To Check Your Property S Value

Osceola County Property Appraiser Katrina S Scarborough Cfa Ccf Mcf Facebook

School Board Meeting Agenda Packet Osceola County

Property Search Osceola County Property Appraiser

Osceola County Property Appraiser How To Check Your Property S Value

Osceola County Fl Property Tax Search And Records Propertyshark

Osceola County Fl Property Tax Search And Records Propertyshark