when are property taxes due in will county illinois

Property taxes are due in two installments. The Second Installment of 2021 Levy Real Estate Taxes is due on September 1 2022.

Online Payment System Tim Brophy

The phone number should be listed in your local phone book under Government County Assessors Office or by searching online.

. Tuesday March 2 2021 Late Payment Interest Waived through Monday May 3 2021. Options for paying your property tax bill. When are taxes due.

Brophy is encouraging all residents to use one of the alternate methods to pay taxes rather than come to the office and waiting in often long lines. Will County Gives You More Time To Pay Property Taxes Will Countys new schedule means half the first property tax bill is due June 3 and the second half is due on Aug. Important message regarding the taxes paid to Claypool Drainage District.

2019 payable 2020 tax bills are being mailed May 1. Property Tax First Installment Due Date. Will County has one of the highest median property taxes in the United States and is ranked 34th of the 3143 counties in order of median property taxes.

Will County collects on average 205 of a propertys assessed fair market value as property tax. Any payment received on September 2nd or after will accrue penalty at an interest rate. Tax Sale Case Numbers.

Mail payments to Will County Collector PO Box 5000 Joliet IL 60434-5000. Property taxes in Cook County are collected one year in arrears. Counties in Illinois collect an average of 173 of a propertys assesed fair market value as property tax per year.

Click on the button above PAY 2021 TAXES. It is managed by the local governments including cities counties and taxing districts. The first is due June 1st and the second is due September 1st.

Election Night Results Contact Calendar Agendas Minutes Maps Employment. Tax amount varies by county. The 2021 tax bills payable in 2022 are being mailed on Friday May 6 2022.

Tax Sale Information for Property Owners. Pay in person at. 1 st Installment due June 1 2022 with the interest to begin accruing June 2 2022 at 15 per month post-mark accepted.

Brophy is encouraging all residents to use one of the alternate methods to pay taxes rather than come to the office and waiting in often long lines. There are several convenient ways to pay your real estate property taxes. Tax bills are mailed in installments twice a year.

The first installment due June 1 will be accepted without late penalty interest payments if paid on or before July 1. Property Tax Second Installment Due Date. If the tax bills are mailed late after May 1 the first installment is due 30 days after the date on your tax bill.

In person weekdays from 830 AM 430 PM at the. If you are a taxpayer and would like more information or forms please contact your local county officials. 2 nd Installment due September 1 2022 with the interest to begin accruing September 2 2022 at 15 per month post-mark accepted.

Real estate tax bills will be mailed beginning on May 1 and the first installment payment will be due June 3. Click Here for the List. The first installment tax amount is 55 of the previous years total taxes.

① Click on Pay Property Tax. Due dates will be as follows. The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000.

Real estate tax bills will be mailed beginning on May 1 and the first installment payment will be due June 3. Look Up Any Address in Illinois for a Records Report. Welcome to Ogle County IL.

Tuesday March 1 2022 Tax Year 2020 Second Installment Due Date. When are property taxes due in Will County. For now the September 1 deadline for the second installment of property taxes will remain unchanged.

The Illinois Department of Revenue does not administer property tax. Find out more. It will bring you to the secure GovTech payment site and this is what it will look like.

The first installment for the 2021 taxes is due by June 6 2022 and the second installment for the 2021 taxes is due by September 6 2022. How do I get my Illinois property tax statement. 3 as the due dates for 2021.

② The next page will be Parcel Number Search. In most counties property taxes are paid in two installments usually June 1 and September 1. 173 of home value.

The median property tax in Will County Illinois is 4921 per year for a home worth the median value of 240500. 16 hours agoFrom 2011 to 2015 one in four Detroit homes went into foreclosure because of failure to pay property tax according to a 2018 study. At one of many bank and credit union branches across Will County.

Due Dates Tax Year 2021 First Installment Due Date. Friday October 1 2021 Tax Year 2020 First Installment Due Date. ③ Select State Illinois.

General Information and Resources - Find information. Tax Sale Instructions for Tax Buyers. Mobile Home Due Date.

First installment 2021 tax bills were mailed late January and were due March 1 2022. Taxes are paid in four installments and the first installment is due in July the second is in September the third in October and the last in. Will County Treasurer Tim Brophy said the board should establish June 3 Aug.

Instructions to pay online. ONCE ON THE GOVTECH PAGE PROCEED AS FOLLOWS. Will County Treasurers Office.

The second installment is due September 1.

No Delay This Time Ford County Property Tax Bills To Be Mailed Friday Ford County Chronicle

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Cypress Texas Property Taxes What You Need To Know Property Tax Tax Attorney Tax Lawyer

Ten Year Trend Shows Increase In Effective Property Tax Rates For Cook County Communities The Civic Federation

Important Tax Due Dates Lee County Il

2022 Property Taxes By State Report Propertyshark

Colorado S Low Property Taxes Colorado Fiscal Institute

North Central Illinois Economic Development Corporation Property Taxes

Increasing Property Taxes Impact Land Owner Returns And Equilibrium Land Values Farmdoc Daily

Property Taxes By State In 2022 A Complete Rundown

Youtube Language Subscrib And View Gk Knowledge Youtube Knowledge

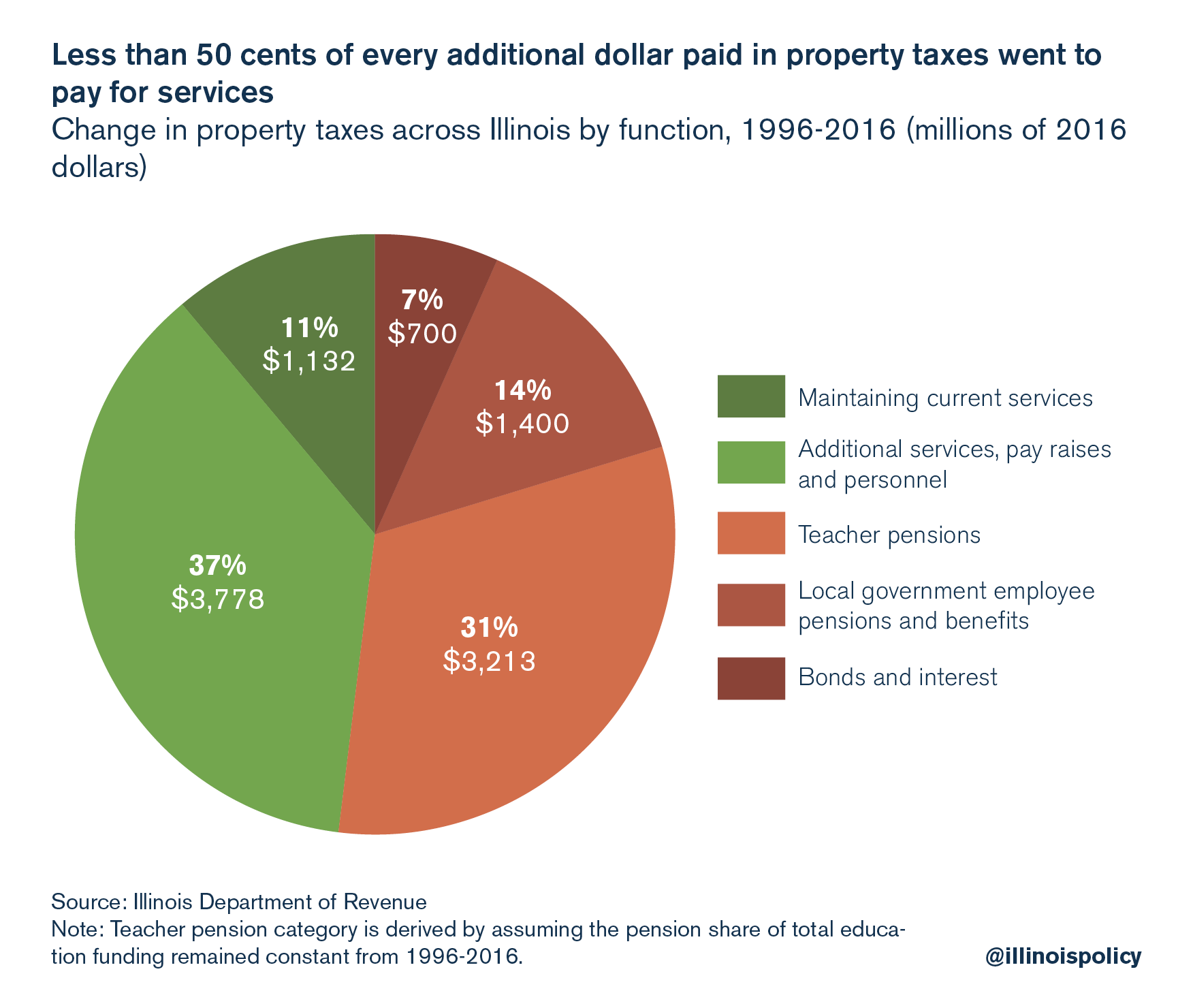

Pensions Make Illinois Property Taxes Among Nation S Most Painful Illinois Policy

Property Tax Prorations Case Escrow

Chicago Property Tax Outlet 60 Off Www Ingeniovirtual Com

Property Taxes By State In 2022 A Complete Rundown

The Cook County Property Tax System Cook County Assessor S Office

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)